Transactions include expenses, asset acquisition, borrowing, debt payments, debts acquired and sales revenues. The fundamental concepts above will enable you to construct an income statement, balance sheet, and cash flow statement, which are the most important steps in the accounting cycle. These are not the only financial statements that can be generated, but they are the most important. When a company moves through all of the steps of the accounting cycle, these statements are the results. If they are viewed together, they can paint a picture of the company’s financial health.

Accounting Software

Another name widely used for Profit & loss statements is the income statement which represents the company’s expenditures and revenues over a given period of time. The structure of the Profit and loss account is different from the Balance sheet statement which predicts a line-wise reporting style. The main content and items of the Profit and loss account include the revenues, cost of goods sold, gross profit, all expenses, and the year-end income. If the amount is negative, it means that the company had incurred a loss and if the amount is positive, it means that the company had earned a significant profit within the specific time period. The accounting cycle serves as the backbone of financial management, providing a systematic approach to track, analyze, and communicate a company’s financial health and performance. When you record transactions in the journal depends on whether you use cash or accrual accounting.

Making Adjusting Entries

- In conclusion, initiating transactions in the accounting cycle involves recognizing transactions, creating journal entries, and maintaining documentation.

- Certified Public Accountant (CPA) Thailand with experience as an external auditor for listed companies who aspires to make accounting easy and accessible for everyone.

- As a small business owner, it’s essential to have a clear picture of your company’s financial health.

- A trial balance helps check the arithmetical accuracy of recorded transactions.

Without accounting, the financial position of a business cannot be analyzed. Nowadays, most accounting is done through accounting software, making the process much easier. After adjustments, there is a need to prepare a trial balance again that ensures that all credits and debits are equal. Adjusting entries are made at the end of an accounting period to adjust those accounts that need to be updated or adjusted.

Small Business Resources

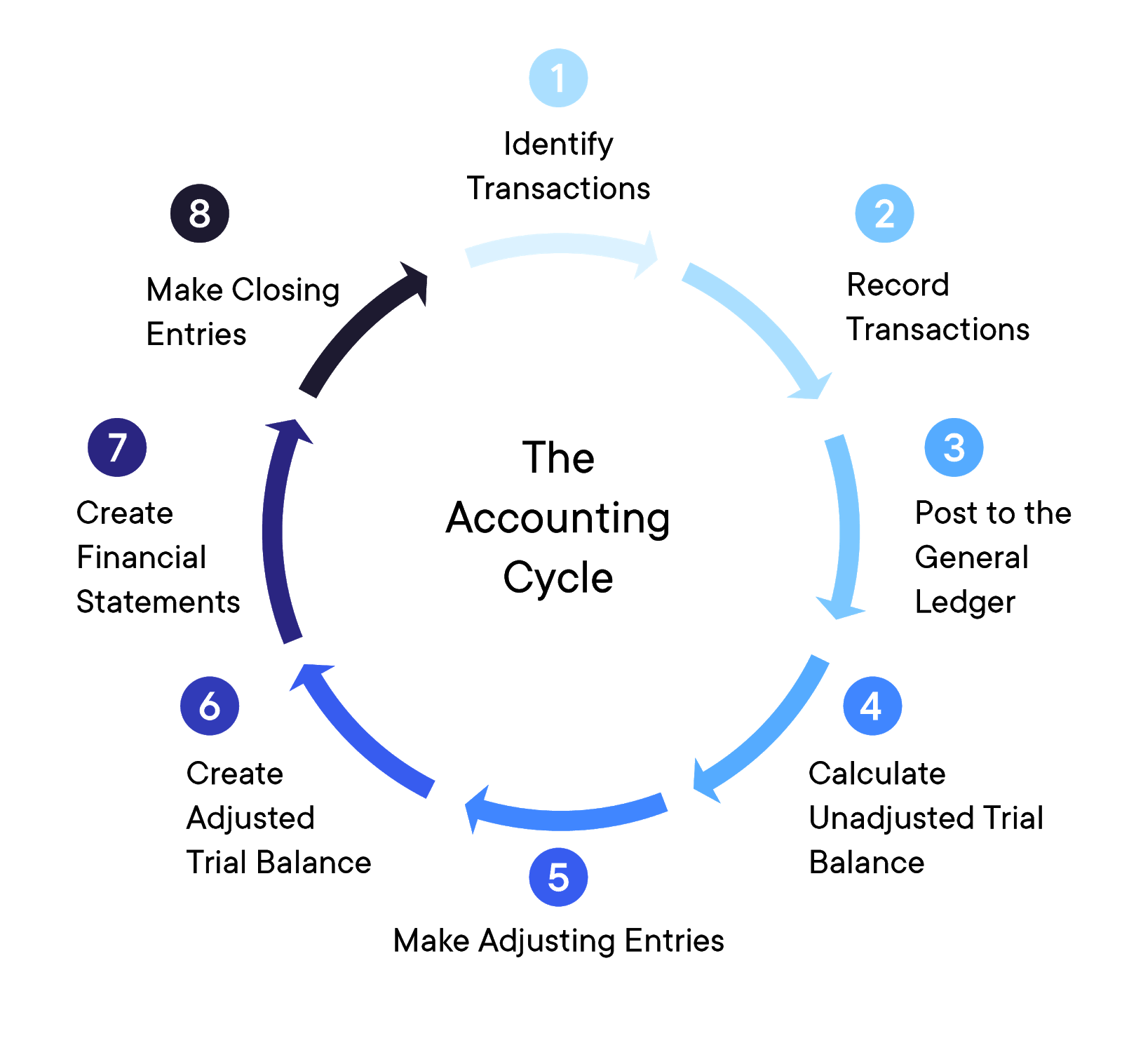

By following the eight-step process, businesses are better equipped to identify errors, inefficiencies, and areas of improvement in their financial procedures. After the company makes all adjusting entries, it then generates its financial statements in the seventh step. For most companies, these statements will include an income statement, balance sheet, and cash flow statement. The last step in the accounting cycle is to make closing entries by finalizing expenses, revenues and temporary accounts at the end of the accounting period.

It’s important because it can help ensure that the financial transactions that occur throughout an accounting period are accurately and properly recorded and reported. This can provide businesses with a clear understanding of their financial health and ensure compliance with federal regulations. The accounting cycle is started and completed within an accounting period, the time in which financial statements are prepared.

While you’ll need to invest some money upfront in purchasing and implementing accounting software, the long-term benefits significantly outweigh the costs. The Retained Earnings Statement demonstrates the changes in retained earnings from one accounting period to another. Retained earnings are the profits that the company keeps to reinvest in the business or pay off debts.

The accounting cycle vs operating cycle are entirely different financial terms. The accounting cycle consists of the steps from recording business transactions to generating financial statements for an accounting period. The operating cycle is a measure of time between purchasing inventory, selling the inventory as a product, and collecting cash from the sales transaction. The next step of the accounting cycle is to organize the various accounts by preparing two important financial statements, namely, the income statement and the balance sheet. The income statement lists all expenses incurred as well as all revenues collected by the entity during its financial period. These expenses and revenues are compared to reveal the net income earned or net loss sustained by the entity during the period.

Once you’ve posted all of your adjusting entries, it’s time to create another trial balance, this time taking into account all of the adjusting entries you’ve made. The main purpose of the accounting cycle is to ensure the accuracy and conformity of financial statements. Although most accounting is done electronically, it is still important product and period costs to ensure that everything is correct since errors can compound over time. Companies will have many transactions throughout the accounting cycle. Every individual company will usually need to modify the eight-step accounting cycle in certain ways in order to fit with their company’s business model and accounting procedures.

It breaks down the entire process of a bookkeeper’s responsibilities into eight basic steps. Many of these steps can be automated through accounting software and other technology, including artificial intelligence. However, knowing the steps and how to complete them manually can be essential for small business accountants working on the books with minimal technical support. The federal government’s fiscal year spans 12 months, beginning on October 1 of one calendar year and ending on September 30 of the next.

The accounting cycle is a standard, 8-step process that tracks, records, and analyzes all financial activity and transactions within a business. It starts when a transaction is made and ends when a financial statement is issued and the books are closed. An accounting period is the time period that financial statements refer to. You have to make sure that all transactions are recorded in a timely manner so that they can be reported. In the digital age, accounting software plays a crucial role in streamlining the accounting cycle. By using powerful software solutions, businesses can simplify bookkeeping processes and improve overall financial management.

Leave a Reply